Blog

Top 5 Payroll Mistakes and How to Avoid Them with Tech

- December 9, 2025

- 10:02 am

Payroll becomes one of the most significant operations in an organization. One error can result in employee discontent, unjustified costs, and even penalties. Sadly, it is still common in many companies to get stuck in the old manual processes, and this raises the risk of the occurrence of Payroll Mistakes.

Modern payroll technology has eliminated such errors, so that the process of payroll becomes smooth, accurate, and compliant.

1. Incorrect Attendance and Time Tracking

Attendance information being wrong or absent is one of the largest Payroll errors. When it comes to manual punching, buddy punching, and spreadsheet updating, there is a great likelihood of having inaccurate calculations.

How Tech Solves It

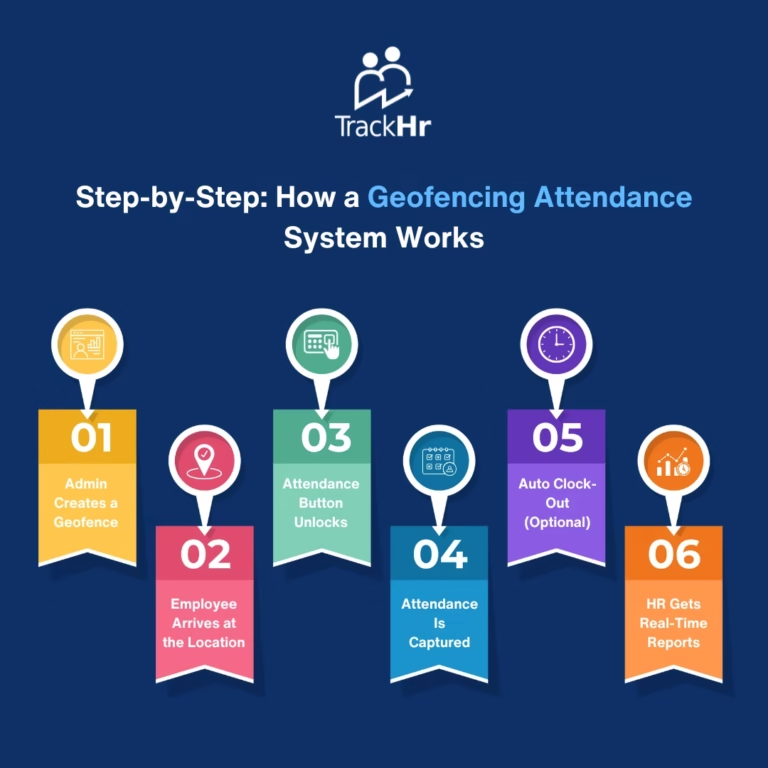

- Attendance tracking based on biometrics or geofencing.

- Work hours, overtime, and shifts are automatically synchronized.

- No handwriting and minimal error.

Intelligent payroll systems guarantee the validity of real-time attendance information to avoid expensive inaccuracies.

2. Miscalculating Overtime and Deductions

Due to manual errors or ambiguous policies, businesses usually get the overtime, tax deductions, or allowance calculation wrong.

This error not only influences wages but also causes compliance risks.

How Tech Solves It

- Overtime rules to be applied automatically.

- Ready-made formulae on deductions and allowances.

- Immediate error notifications when information does not match the guidelines.

Technology makes sure that there is no overtime and deductions that are not in compliance with the company policies and the labor laws.

3. Missing Compliance Updates

The labor laws, tax, and state-wise payroll rules keep on changing, and thus, it is hard to keep up with them.

The fines and legal difficulties are one of the most expensive Payroll Mistakes that cannot be overlooked.

How Tech Solves It

- Automated compliance changes.

- In-built tax calculators in accordance with the current laws.

- Friendliness to auditors reporting features.

Payroll software keeps the company on the right side of the law without any manual follow-up.

4. Poor Record-Keeping and Documentation

The record-keeping system in the form of manual records, paper files, or spreadsheets that are spread out makes it difficult to follow past payroll data.

This confuses both at audit times and throughout staff enquiries, and during internal audits.

How Tech Solves It

- Digital records management on the cloud.

- Payslips, history logs, and reports are easily accessible.

- Encrypted, secure, off-site storage.

Effective documentation minimises conflicts and enhances accountability.

5. Human Errors Due to Manual Processing

The most frequent Payroll Mistakes are typing errors, duplication, or lost updates, and manually computing payroll.

How Tech Solves It

- Computerized payroll calculations.

- Validation rules to identify erroneous entries.

- Attendance, leave, and payroll: the end-to-end integration of payroll, attendance, and leave.

The automation minimizes human interference in monotonous duties that are likely to cause errors.

Conclusion

Errors made on payroll may cost the business money, time, and trust. Nevertheless, all these typical Payroll errors can be prevented using the appropriate technology. Payroll systems that are automated are more accurate, require less manual work, are more compliant, and make employees happier.

The businesses that switch to smart payroll technology enjoy an easier process, reduce the number of disputes, and have a more consistent HR workflow.

Exhausted from managing performance management manually?