Blog

TrackHr Payroll Review: Features, Benefits, and How It Works

- June 5, 2025

- 9:22 am

Running payroll manually is time-consuming, error-prone, and difficult to scale. That’s why more businesses are turning to automated payroll systems like TrackHr Payroll — a comprehensive solution designed to streamline payments, ensure compliance, and integrate seamlessly with attendance systems. In this review, we break down what makes TrackHr Payroll stand out, the benefits it delivers, and how it works.

Key Features of TrackHr Payroll

1. Automated Salary Processing

No more manual calculations. TrackHr Payroll automates salaries, deductions, bonuses, and reimbursements based on customizable rules.

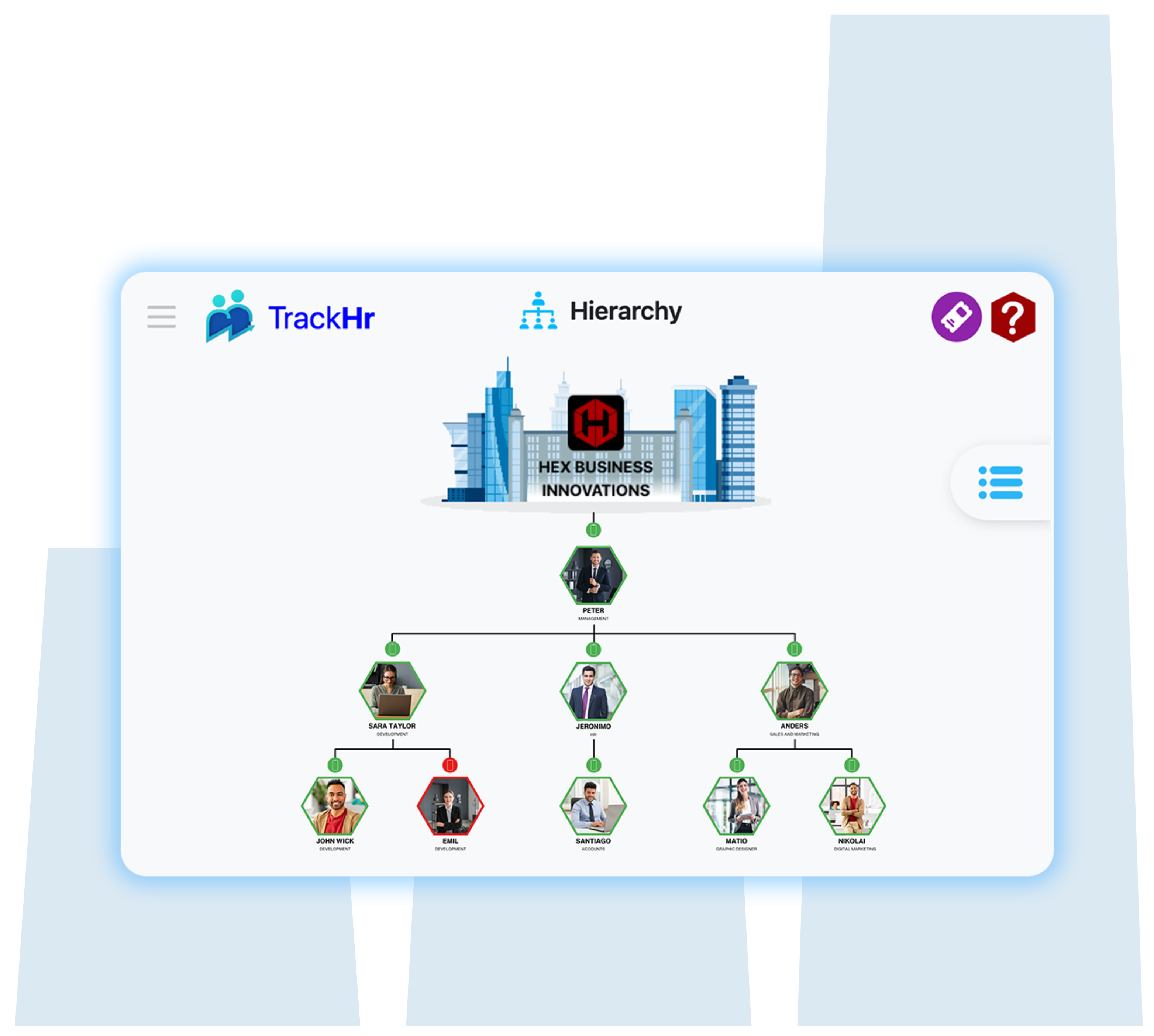

2. Integrated Attendance Data

With real-time integration with TrackHr’s attendance system, the payroll module ensures accurate payout based on actual working hours and leave records.

3. Tax and Compliance Updates

The system stays updated with changing tax laws and statutory requirements, making it easier to stay compliant with minimal effort.

4. Custom Pay Structures

Design flexible pay structures based on departments, roles, or contract types. This helps companies accommodate a wide variety of employee compensation models.

5. Payslip Generation & Reporting

Generate digital payslips, TDS reports, and audit-friendly documentation with just a few clicks. Reports can be exported for accounting or HR audits.

6. Role-Based Access & Security

Only authorized users can access payroll data. End-to-end encryption and access logs protect sensitive employee information.

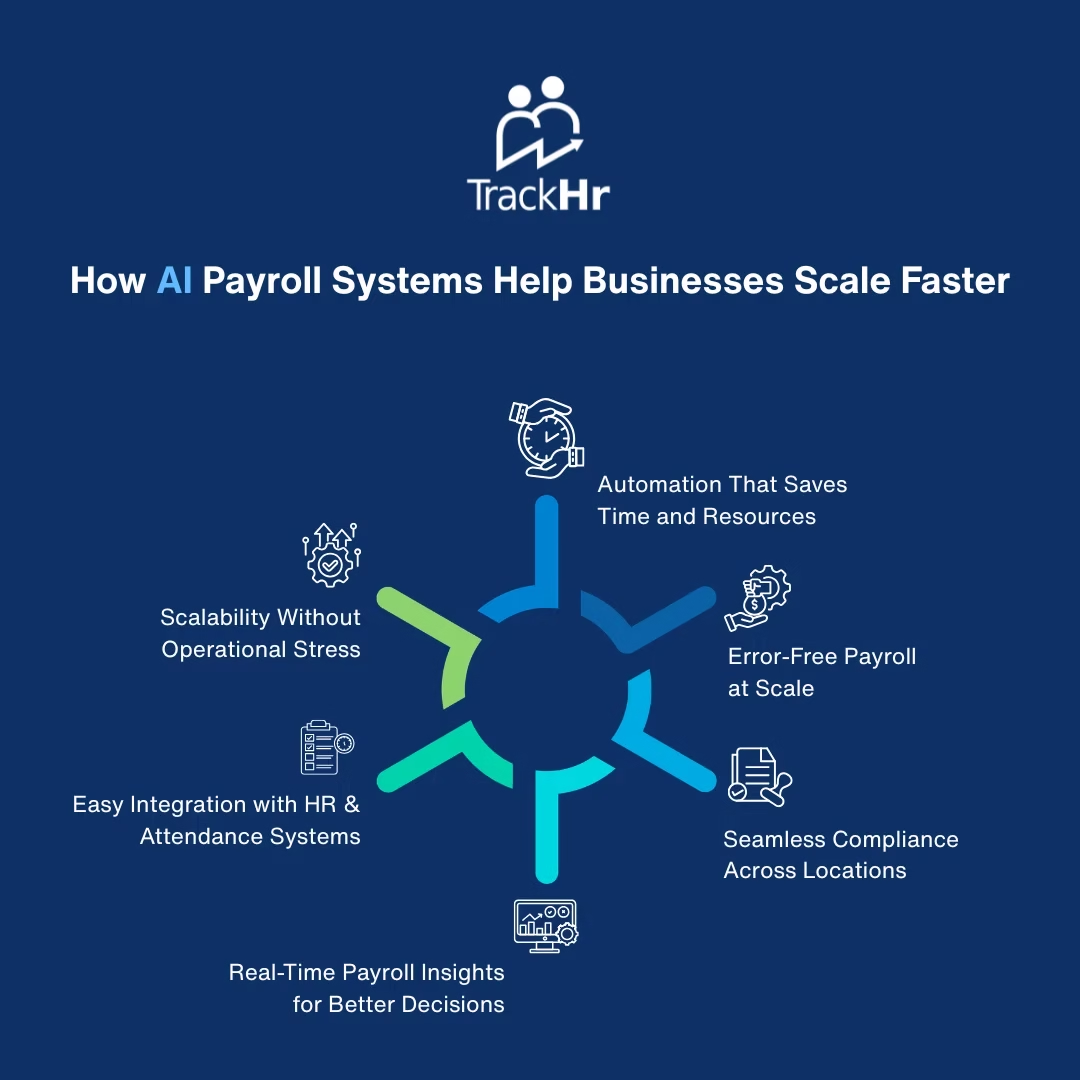

Benefits of Using TrackHr Payroll

Accuracy and Speed

Automating payroll reduces the chance of human error and shortens payroll cycles drastically.

Improved Compliance

Built-in features ensure the company stays compliant with labor laws, tax codes, and employee benefit obligations.

Seamless Integration

TrackHr Payroll works hand-in-hand with its attendance and HR modules, reducing the need for data imports or duplication.

Employee Satisfaction

Timely and error-free salaries, transparent payslips, and compliance contribute to higher employee trust and satisfaction.

Scalability

Whether you’re a startup or an enterprise, TrackHr Payroll scales with your business without needing significant process overhauls.

How TrackHr Payroll Works

- Setup

Configure salary structures, tax settings, and bank details for employees. - Connect Attendance

Sync attendance and leave records automatically from TrackHr’s time-tracking system. - Run Payroll

Click once to process payroll for the entire organization, review summaries, and approve. - Generate Payslips & Reports

Employees receive digital payslips, and admins can export compliance-ready reports. - Stay Compliant

Use automated alerts and filing tools to stay ahead of tax and labor requirements.

Who Should Use TrackHr Payroll?

- Startups looking for an affordable, easy-to-use payroll system

- Growing companies needing integrated HR and payroll in one dashboard

- Enterprises wanting compliance, customization, and control

Conclusion

TrackHr Payroll is more than just a payroll processor — it’s a smart, secure, and scalable payroll solution. From automated payouts to legal compliance and real-time integration with time-tracking tools, it offers everything a business needs to streamline payroll management.

Table of Contents

Exhausted from managing performance management manually?