Blog

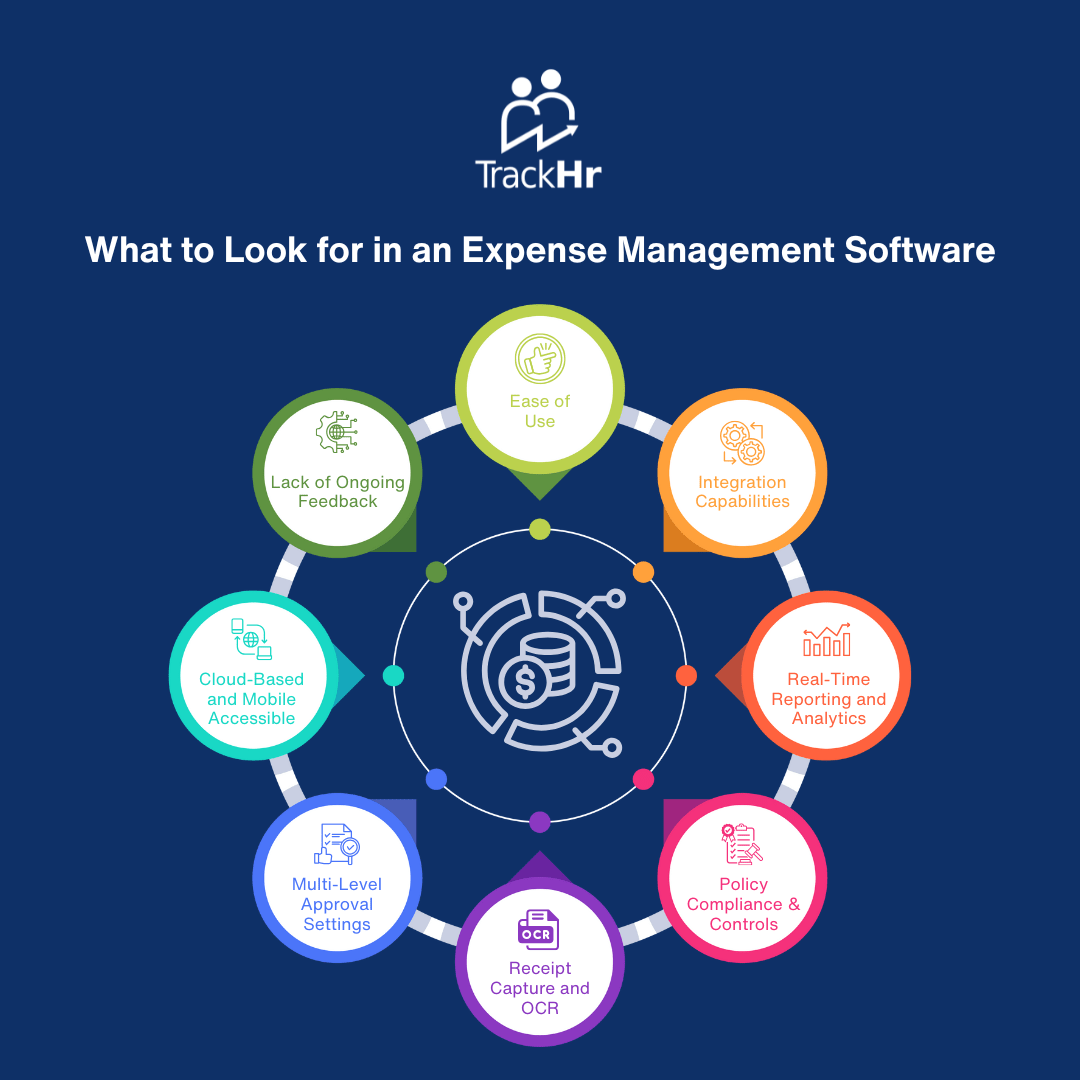

What to Look for in an Expense Management Software

- July 12, 2025

- 9:41 am

It is possible to make mistakes when handling business expenses manually and suffer delays and compliance risks. This is the reason why the proper selection of expense management software is important in any business that wants growth and efficiency. In this article, we will deconstruct the key features and considerations when making this decision to help you make the best choice in your organization.

1. Ease of Use

The interface of a good expense management software must be comfortable to use by the employees and the administrators. There should not be much training on submitting receipts, approving claims, and generating reports.

Look for:

- Apps that are mobile-friendly

- Drag and drop uploads

- Universal dashboard-easy navigation

2. Integration Capabilities

Your expense management software must fit seamlessly with other systems you have in place, e.g:

- Payroll systems

- Software accounting

- Hr management tools

- Corporate cards and bank systems

This makes data flow accurate and minimizes duplication.

3. Real-Time Reporting and Analytics

To make data-driven financial decisions, you require clear insights. Inbuilt reporting tools in software will enable the finance department to track all spending trends, identify out-of-line spending, and create efficient budgets.

Bonus: Dashboards to showcase important data such as top spenders, violations under the policy, and expenses on a department-wise basis.

4. Policy Compliance and Controls

Make sure that the software is able to manage expense policies in your company automatically. These should have features of:

- Spending caps

- Rules that are specific to a Category

- Out of policy claim flagging

- Ready to audit logs

Tools such as TrackHr Expense Tracker facilitate the adherence to the built-in control mechanisms.

5. Receipt Capture and OCR

The data on receipt images can be read and imported into the system by selecting one with OCR (optical character recognition). This is time-saving and accurate.

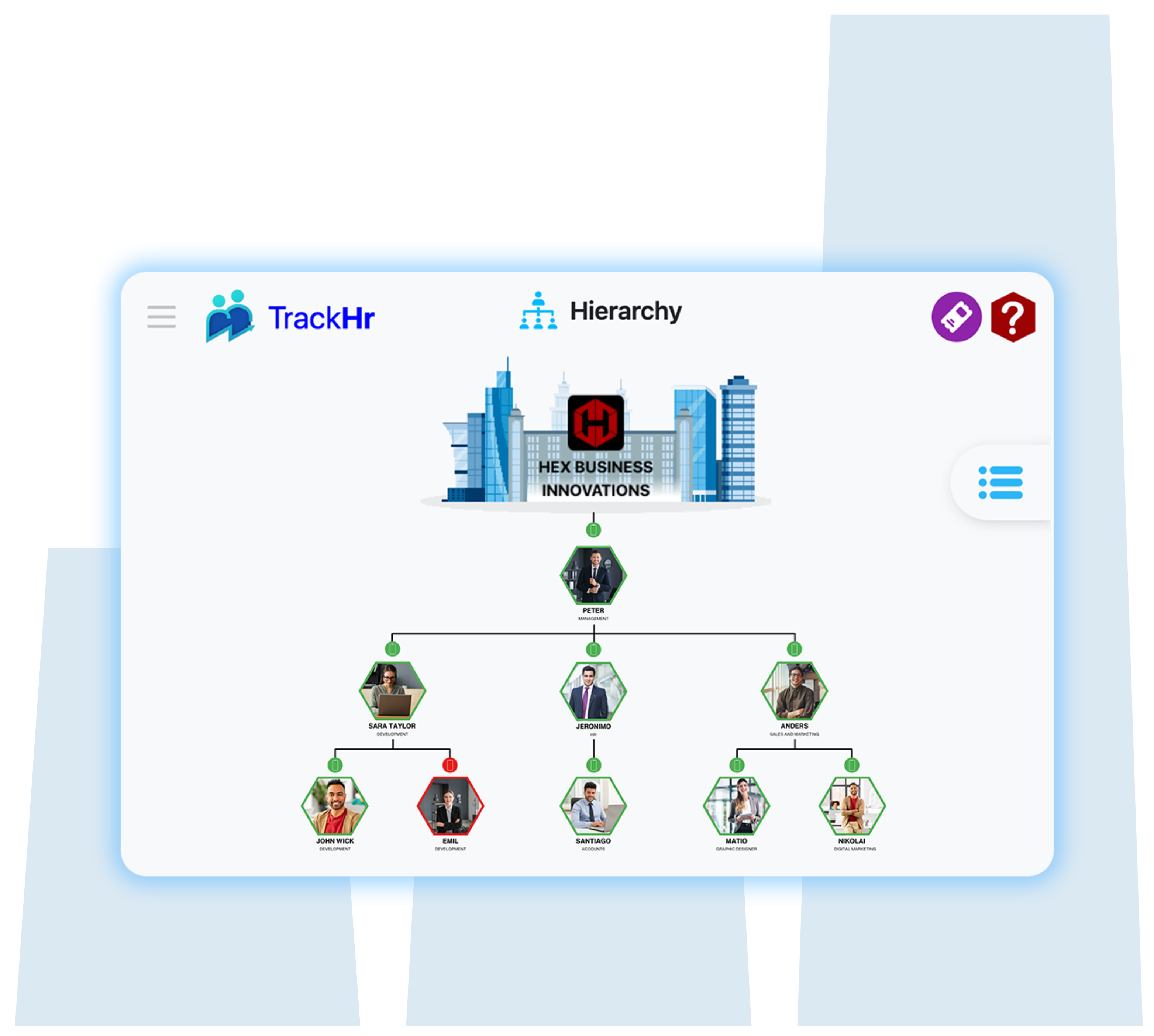

6. Multi-Level Approval Settings

Large teams require support tiers of authorizations. Select a software with the possibility of configuring:

- Heads of departments

- Project-based approvers

- Gatekeepers of finance

This will provide effective supervision devoid of bottlenecks.

7. Cloud-Based and Mobile Accessible

As remote work and travel are the new normal, the mobile-compatible expense management software in the cloud guarantees that your team can process and authorize expenses wherever they are.

Conclusion

Selecting the correct expense management software is not only convenient, but it is more about saving time, costs, and errors within your organization. In making your choice, concentrate on usability, automation, integration, and compliance. Applications, such as TrackHr, have a fully integrated, scalable, and secure solution for businesses both small and big in size.

Table of Contents

Exhausted from managing performance management manually?